Our responsible investment offering

Our responsible investment offering is divided into three product types, which address, in varying degrees of intensity, non-financial criteria in their investment process :

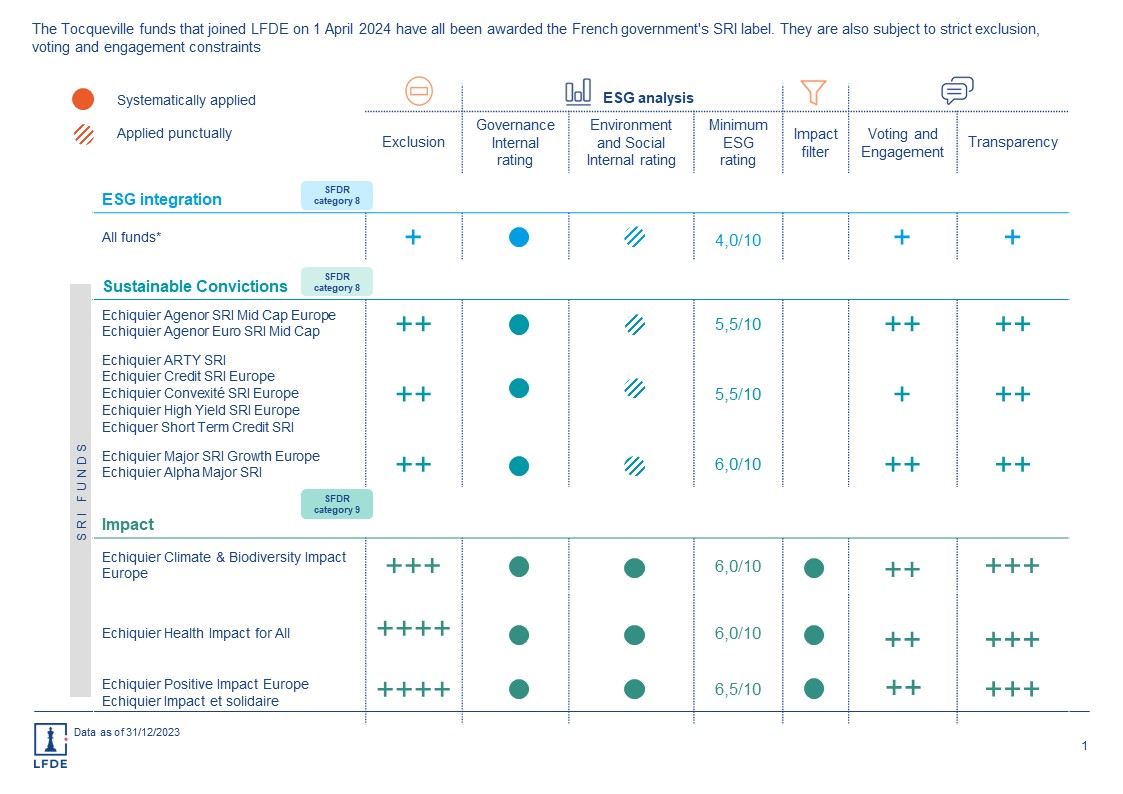

ESG integration

The aim of this approach is to take ESG risks and opportunities into account. Our ESG-integrated funds apply a common filter of sectoral and normative exclusions and a minimum ESG rating to ensure that we do not invest in high-risk companies from an ESG perspective.

Sustainable convictions

Financing a sustainable economy is central to the investment process of our SRI funds. Additional sectoral exclusions are applied. Non-financial criteria are comprehensively factored into the management process. A minimum ESG rating means that for the funds concerned, at least 20% of the investment universe is excluded

Impact

The search for a measurable positive impact is central to our impact funds’ strategy. To maximise this environmental and social impact, our selection of portfolio companies is based on innovative and sophisticated proprietary methods.

Our investment approach

Our responsible investment approach consists of several stages. Each product type has its own unique characteristics. Exclusions, transparency and commitment: find out more about our approach.

Responsible asset allocation

Using our proprietary analysis method “SRI Maturity”, we offer dedicated asset allocation solutions incorporating a non-financial dimension. On your behalf, we will select responsibly managed funds with exemplary ESG analysis, willingness to engage in shareholder dialogue and transparency.

Responsible asset allocation

Using our proprietary analysis method “SRI Maturity”, we offer dedicated asset allocation solutions incorporating a non-financial dimension. On your behalf, we will select responsibly managed funds with exemplary ESG analysis, willingness to engage in shareholder dialogue and transparency.

Find out more

Our ESG analysis

Our ESG analysis methodology is based on meetings with company leaders focused on sustainable development issues.

For further information